programming - Inverting the Black formula for Cap price to find Black implied volatility - Quantitative Finance Stack Exchange

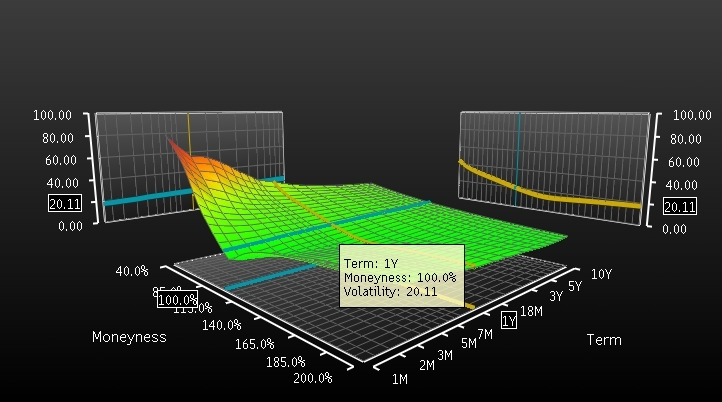

Volatility Surface. Financial institutions consume market… | by Farhad Malik | FinTechExplained | Medium

Using the Bootstrapped Market SOFR Caplet Normal Vol Surface to Price in Excel Interest Rate Caps/Floors on Backward/Forward Looking SOFR Term Rates - Resources

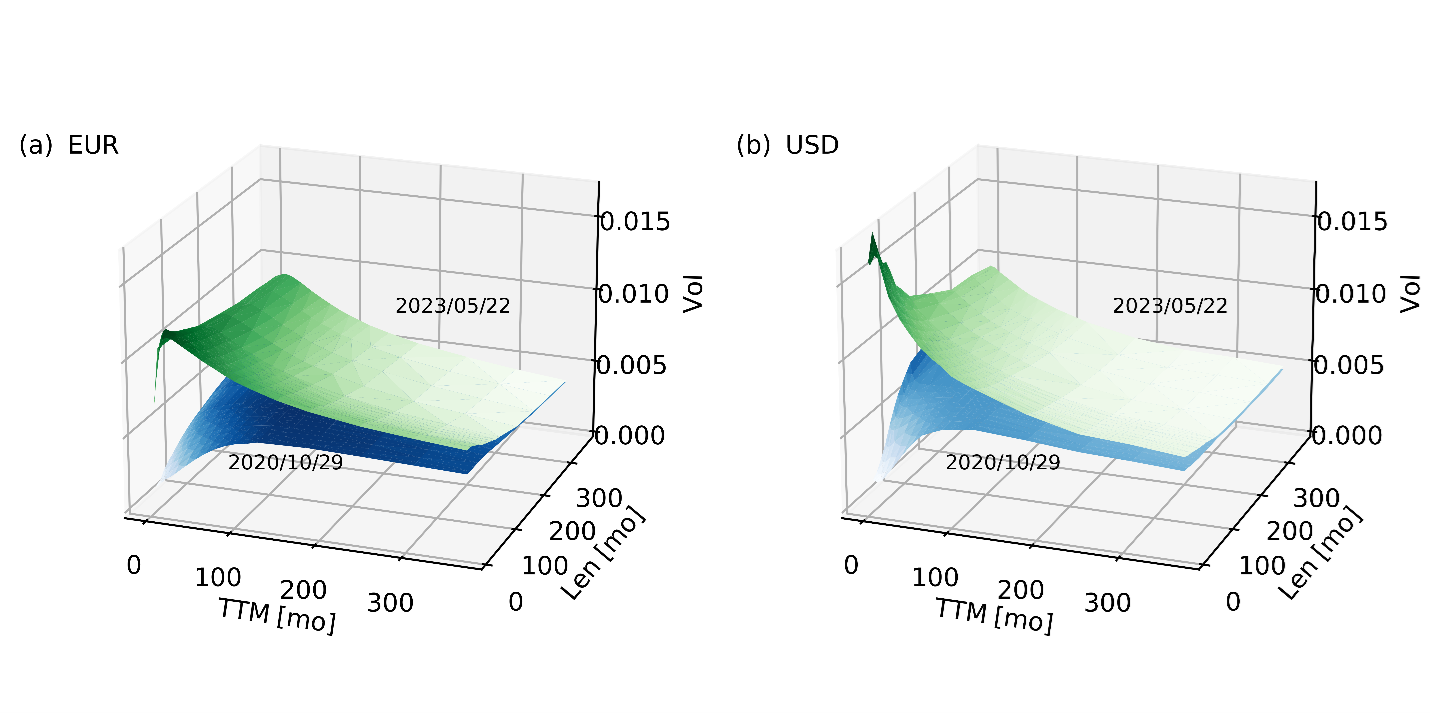

Implied Interest Rate Volatility and XVA: How the One-Factor Hull-White Model is Weathering Changing Markets | S&P Global

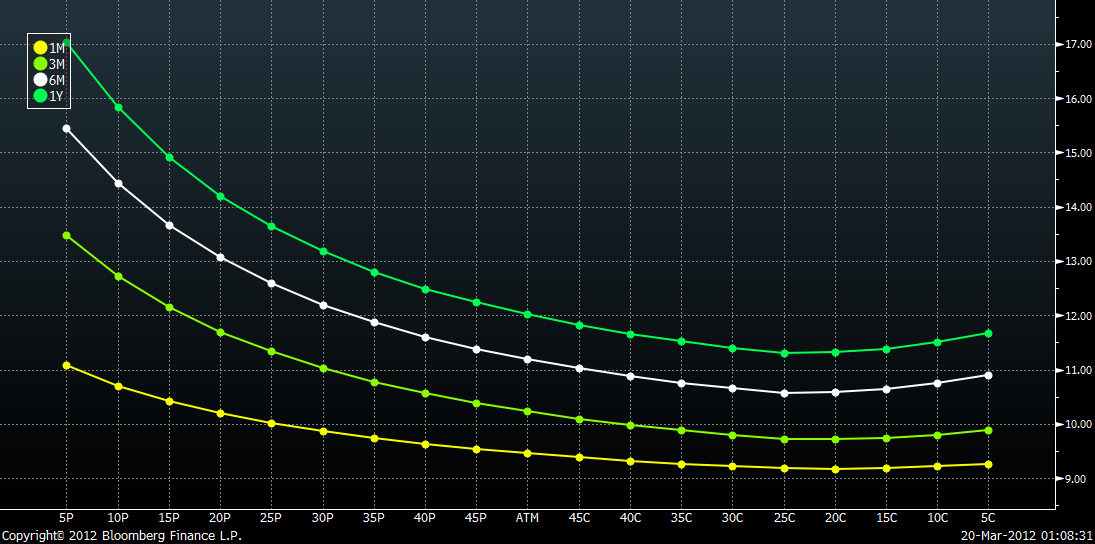

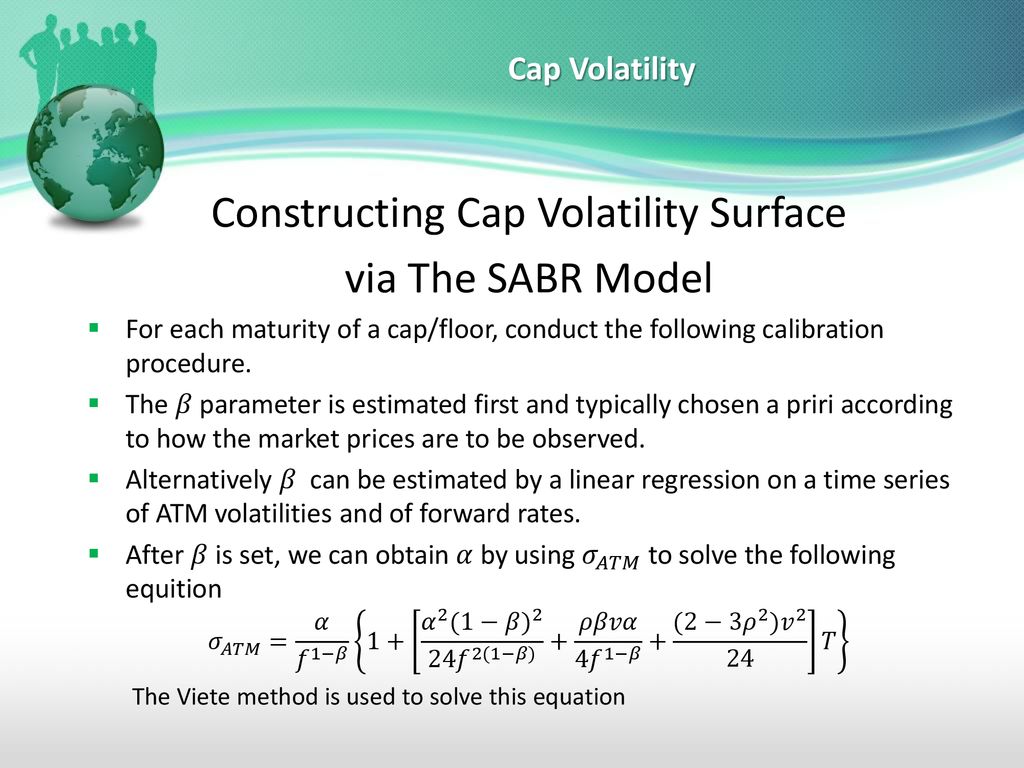

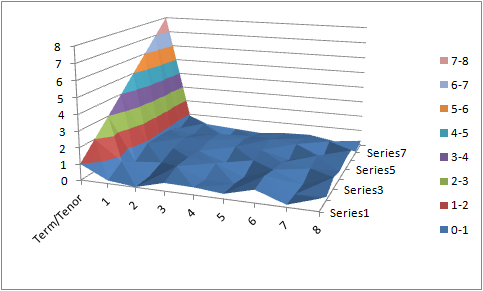

Cap Volatility Surface An implied volatility is the volatility implied by the market price of an option based on the Black-Schol

Using the Bootstrapped Market SOFR Caplet Normal Vol Surface to Price in Excel Interest Rate Caps/Floors on Backward/Forward Looking SOFR Term Rates - Resources